Financial modelling expertise

All my modelling is done in Excel, based on the FAST standard. The models are very suited to support investment decisions, perform due diligence or business valuations. The modelling method can also be used for scenario analyses or non-financial optimisations.

Tree Line Design operates together with other independent experts on financial modelling. Together we have all the knowledge, expertise and experience you need.

MOdel Building

Building models is what we do best. Do you have M&A project coming up, do you have a new investment to be approved?

The models we make, provide you with the best insights to make the best informed desicions.

TEaching

Are you curious to learn to built your own financial models? Do you want to understand the FAST method? Do you have a team of smart investment analysts eager to start modelling?

We give in-house training from introduction level to detailed debt-financing and complex valuation methods.

Model reVIEW

Don’t you trust your own models any more? Do you need a quality check for an new, unknown, model?

We do model reviews, model rebuilts and model check-ups.

Well built Excel models provide overview and insight, are easy to adjust and easy to expand

Meet the network of experts:

Tree Line Design collaborates with other independent experts in financial modelling. This ensures sufficient model building capacity, quality control by peer-reviewing and up-to-date knowledge.

OWNER TREE LINE DESIGN

Thomas van de Sande

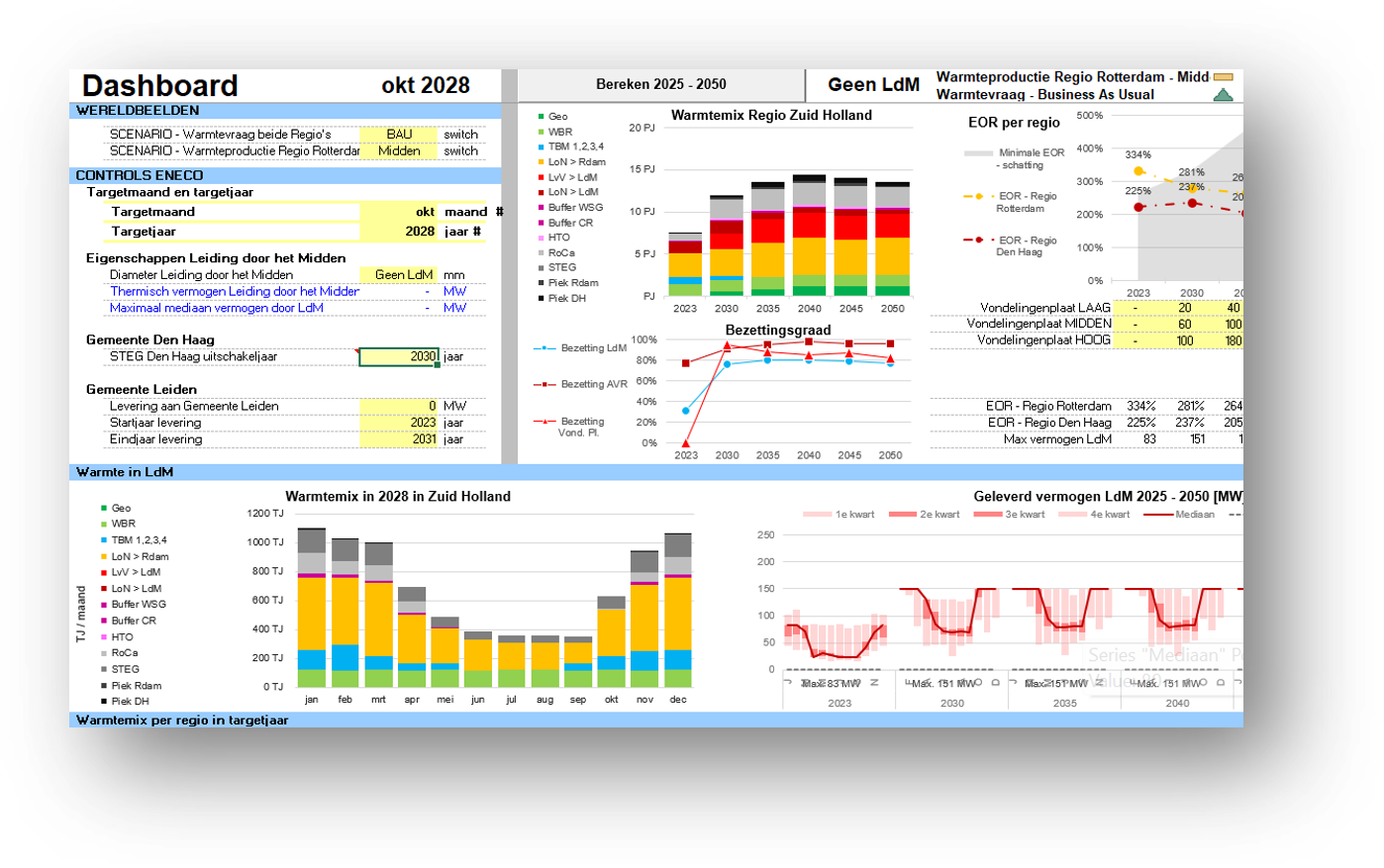

Thomas van de Sande MSc has 10 years of experience in modelling and presenting complex data to senior management. He has led the CAPEX Investment team (12 persons) of the Netherlands’ largest utility company; Eneco. His team was responsible for all renewable project investments; ranging from large offshore wind, solar, power generation and district heating.

Thomas started his career as a logistics and supply chain consultant and therefore has a quick understanding of complex technological value chains, while also understanding the financial challenges.

Since 2021, Thomas is an independent consultant focussing on sustainable energy projects. He left Eneco sinds October 2023 and is now fully focusing on sustainable energy projects, bio-based buildings and forestry.

He lives in Rotterdam, the Netherlands and is fluent in Dutch and English.

INDEPENDENT FINANCIAL EXPERT

Sebastian Szameitat

Sebastian is a passionate expert in financial modelling. He has more than 20 years of experience in the financial sector, over 15 years of realising infrastructure projects. His roles included investment management, analysis and modelling as well as risk management, so that he looks at every project from several angles. He has a focus on real assets, such as renewables, real estate, shipping, data centres etc. and he was involved in countless transactions providing financial modelling services including tender and project management, model build, model review and modelling training.

Until 2022 Sebastian has worked 15 years for two internationally operating investment companies and alternative investment fund managers (“AIFMs”) where he developed his M&A and corporate finance experience and was responsible for the centralised knowledge management, the development and management of standards, technical reviews and trainings for financial modelling.

Sebastian and his family live in Luxembourg since 2015 and he is fluent in German and English.

INDEPENDENT FINANCIAL EXPERT

Mark Ringrose

Mark is a recognised expert in financial modelling. He has more than 25 years experience helping clients realise infrastructure projects and is a recognised expert in financial modelling delivering for clients across Europe. He has a focus on renewables and transportation projects and has directly supported many blue-chip clients with financial modelling services including tender and project management, model build, model review and modelling training.

Mark started his career in project risk management, developing risk management plans and undertaking project risk analysis and Monte Carlo modelling on projects in naval and construction services.

Between 2000 and 2014 Mark worked at KPMG Corporate Finance focussing on PPP projects developing bid-winning models for private sector clients while at the same time supporting public sector clients in bid appraisal and negotiation. Mark’s M&A and corporate finance experience was developed further after a move to KPMG Germany in 2006 working on renewable energy and transportation projects where he oversaw the development of the models required to evaluate infrastructure related transactions.

Mark is a dual German and UK citizen and speaks fluent English and German.

“All models are wrong, but some are useful”

George E.P. Box – British statistician, 1976

We do not have a crystal ball, and cannot foresee the future,

but our forecasting models come pretty close