The experts in the Financial Modelling Cooperation have a wide range of skills. We can help you with various financial modelling demands. The main things we can do are: (re)building financials models, training you and your colleagues to build your own models and reviewing models on robustness and quality

Model build

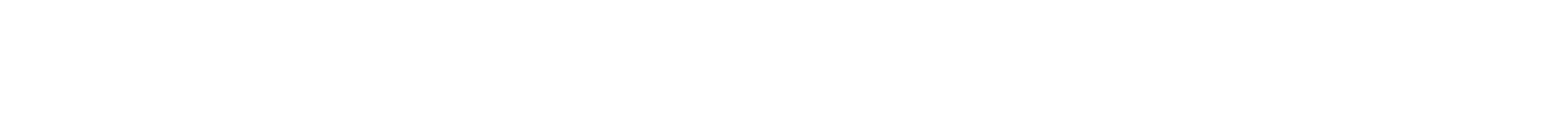

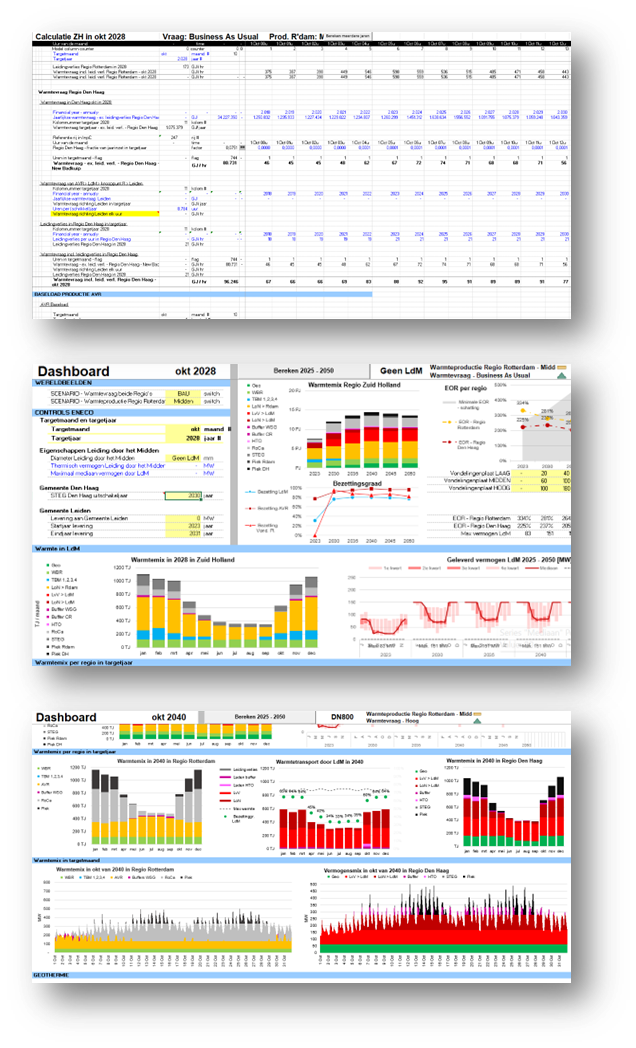

We provide professional and efficient model build and model rebuild as a service. Our models are clearly structured, transparent, and robust. The modular design of our models makes them flexible and modifiable for changes.

Model training

We have been teaching analysts, managers and CFOs how to build, review and update financial models that are clear, transparent and robust

Our training curriculum entails:

Model review

We review your models, or models you have received from external parties. This technical model review service is designed to de-risk the models you use for decision-making.

More services

Beside our major expertises we also deliver other services:

Model build

Modelling tomorrow, today

At the Financial Modelling Cooperative, we understand that a financial model is not just about crunching numbers; it’s about achieving your business goals. With decades of experience across a wide range of projects and transactions, we build models that help you succeed in various scenarios. Whether you are competing in public sector tenders, bidding for offshore renewable development rights, acquiring operating assets, or monitoring cash flow performance, our models are designed to support your needs.

Financial models do more than just calculate – they support your strategic thinking, guide decisions, and facilitate conversations with your team. We focus on creating models that are not only accurate but also serve as tools to help you navigate complex business landscapes.

Each financial model is shaped by the unique social and business context in which it operates. While the primary function of a model may be computational, it also plays a critical role in helping you make informed judgments, reach compromises, and explore new opportunities. Whether you’re evaluating the value of a tender, finding a middle ground in negotiations, or exploring innovative possibilities in a new sector, our models are designed with these broader objectives in mind.

Our model design is always guided by the understanding that the purpose of a model evolves throughout its lifecycle, and we tailor our approach to meet those changing needs.

Model review

Models you can trust

We provide a quick, efficient and stress-free model review service highlighting where potential problems in your model are hiding. Through these model reviews, we ensure that all calculations are correct, consistent, and robust. Our model review process is supported by market-leading model review software. Not intended as an audit, our review service is a quick means of providing you with a list of actions to de-risk your model. Our model review service is focused on technical integrity and consistency to ensure your models are of the highest quality. When needed, we can provide shadow models of the to be reviewed models or complete model rebuilds as well.

Model training

Our training program contains various courses, suited for any type of financial modelling needs. We deliver courses in-house at your company or live on-line. Every training can be customed to your specific needs, industry, or desired learning path. For more detailed enquiries please contact us.

Best practice financial modelling

We are teaching you the good principles of financial modelling. You will learn to design your model following best practices and avoid pitfalls.

Introduction to FAST Financial Modelling

Delegates on this course learn to create a 3-statement financial model (Profit-Loss, Balance Sheet and Cash flow) and set up scenario manager to bring the model to life. Delegates will calculate an equity valuation, cover basic debt financing, inflation, depreciation and taxation. The course will also highlight all the efficiency steps you can take to speed up your model build.

FAST Project Finance Modelling

Learn to build a project finance model covering the entire life of the concession – from the beginning of construction to the end of operations – which meets the requirements of 3 key stakeholders: customer / off-taker, senior lender and equity investor. Two case study versions are available, one renewables focused, the other PPP in nature.

Model review for investment managers

Even if you do not build financial models yourself, the spreadsheet models received by others might be a crucial part of your daily business. If it is important for you to read, understand and analyse the models, run sensitivities and stress tests and analyse the delta between different scenarios, but also identify potential risks, this is the right course for you.